Eligible patients with private insurance may pay $0 per month Novartis will pay the remaining co-pay, up to $15,000 per calendar year, per product. To find out if you are eligible for the Novartis Oncology Universal Co-pay Program, call 1‑877‑577‑7756 or visit Copay.NovartisOncology.com.

Last Updated : 10/31/20193 min read

If you’re doing some research about Medicare Advantage plans, you might have discovered some $0-premium Medicare Advantage plans. But just because a Medicare Advantage plan has a zero premium doesn’t mean the plan covers all your health-care costs.

Find affordable Medicare plans in your area

- If you’re fortunate enough to have employer-provided insurance, the company typically picks up part of the premium. Copay: A predetermined rate you pay for health care services at the time of.

- The majority of people pay $0 a month for the #1 prescribed branded pill for plaque psoriasis. † Wondering if you qualify? Fill out and submit the form above or call 1-844-4OTEZLA. Even if you have health insurance through your employer, you’re eligible to pay $0 each month for Otezla.

What are $0-premium Medicare Advantage plans?

No matter whether they have a $0 premium or not, Medicare Advantage plans give you an opportunity to receive your Medicare benefits through a private insurance company contracted with Medicare.

Under the Medicare Advantage (also called Medicare Part C) program, plans must offer the same benefits as Original Medicare, Part A and Part B, but if you need hospice benefits, they’d come directly through Medicare Part A instead of through the plan.

What out-of-pocket costs might $0-premium Medicare Advantage plans have?

Medicare Advantage plans (whether $0-premium or not) typically come with certain out-of-pocket costs, just as most health insurance does. These expenses may include copayments, coinsurance, and deductibles.

- A deductible is the amount you have to pay before your Medicare Advantage plan pays its share of covered services. Not every plan might have a deductible amount, and they may vary among plans.

- A copayment is generally a set dollar amount you may have to pay for a covered service (for example, $15).

- A coinsurance amount is a percentage of the total cost that you may have to pay for a covered service (for example, 20%).

Insurance companies offering Medicare Advantage plans have some flexibility in setting their rates. Plan premiums, deductibles, coinsurance amounts, and copayments may vary among plans.

Another cost-related item to consider is the plan’s maximum out-of-pocket amount. Every Medicare Advantage plan, including $0-premium plans, has an out-of-pocket maximum that can vary among plans and might change year to year. This amount is the total cost you have to pay for Medicare-covered services. Once you have spent a certain amount on these services in one calendar year, you won’t have to pay any more for covered services that year.

So, before you decide to enroll in a $0-premium Medicare Advantage plan, you might want to look at these other costs. It may be a good idea to compare all costs among plans when you’re looking at Medicare Advantage plans.

What else do I need to know about $0-premium Medicare Advantage plans?

Average Medicare Advantage premiums dropped 33 percent year over year in 2019, according to eHealth research. The popularity of $0-premium plans contributed to the low average premiums.

Medicare Part D plans are not available with $0-premiums.

Whether or not it’s a $0-premium Medicare Advantage plan that you sign up for, you still need to continue paying your Medicare Part B premium, in addition to any premium your plan may charge. You’re still in the Medicare program even when you receive your benefits through a Medicare Advantage plan.

As you can see, the cost of a Medicare Advantage plan’s premium isn’t all there is to choosing which Medicare Advantage plan may be right for you. It could be a $0-premium Medicare Advantage plan, or a different plan that might suit your needs. Would you like help comparing $0-premium Medicare Advantage plans and other Medicare health plans? Just enter your ZIP code on this page.

A copay after deductible is a flat fee you pay for medical service as part of a cost sharing relationship & health insurance must pay for your medical expenses.4 min read

1. Copay After Deductible: Everything You Need to Know2. Deductible: What Is It?

3. Are Coinsurance and Copay the Same Thing?

What Does $0 Copay Mean

4. What Is the Difference Between Aggregate and Embedded Deductibles?

Copay After Deductible: Everything You Need to Know

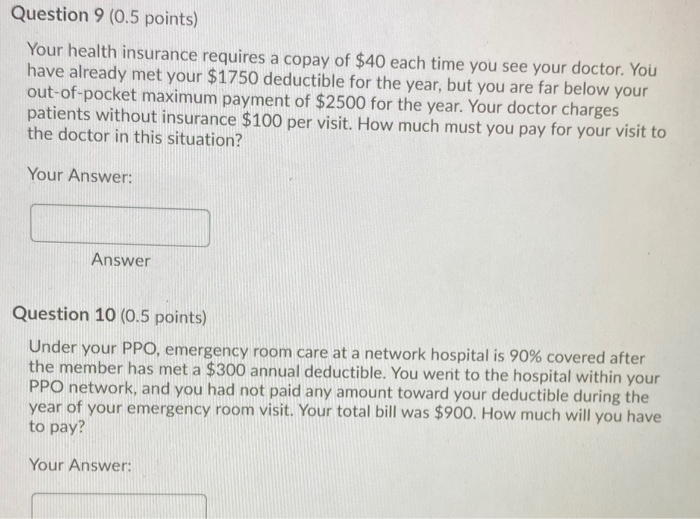

A copay after deductible is a flat fee you pay for medical service as part of a cost-sharing relationship in which you and your health insurance provider must pay for your medical expenses. Deductibles, coinsurance, and copays are all examples of cost sharing. If you understand how each of them works, it will help you determine how much and when you must pay for care.

Deductible: What Is It?

The amount you pay for medical services before your health insurance starts paying is known as a deductible. For example, if your insurance deductible is $1,500, you will be responsible for paying all of the pharmacy and medical bills until the amount you pay has reached $1,500. At that point, you begin sharing some future costs with the insurance company through copays and coinsurance.

Typically, a health insurance plan with a high deductible will require you to pay fairly inexpensive payments monthly. Although, initially, you will have to pay a significant amount up front if you were to need care. You may consider looking for plans that will pay for some services before you must pay your deductible. If you are mostly healthy, then it may be a good idea to increase your deductible as an easy way to lower your monthly payments or premiums. However, if you do this and then get sick, your medical bills in a year will be high.

Hospitalizations, blood tests, or surgical procedures may be services you pay for annually as part of your health insurance deductible. These services do not include routine care. Usually, preventative checkup services will just require that you make a co-payment. After the deductible has been met, your insurance will cover the expenses.

In a majority of circumstances, neither premiums nor copays count toward your deductible. Examples of health care costs that may count toward your deductible may include the following:

- Chiropractic care

- Hospitalization

- Mental healthcare

- Surgery

- Pacemakers and other medical devices

- Lab tests

- Physical therapy

- MRIs

- Anesthesia

- CAT scans

Are Coinsurance and Copay the Same Thing?

0 Copay Insurance

Copay and coinsurance are similar, but coinsurance is a percentage of costs, as opposed to a fixed dollar amount. A percentage of the amount an insurance company will allow a healthcare provider to charge for service gets determined when calculating the amount of a person's coinsurance. It is your share of the medical costs which get paid after you have paid the deductible for your plan.

0 Copay Medical Insurance

An example of paying coinsurance and your deductible would be if you have $1,000 in medical expenses and the deductible is $100 with 30 percent coinsurance. You would pay $100 along with 30 percent of the remaining $900 up to your out-of-pocket maximum, which would be the most you would pay in a year.

Not all plans have coinsurance, but you may find plans with cost sharing of 50/50 or 20/80 coinsurance, or other combinations. Usually, if you are making small monthly payments for your plan, you may expect to pay more in coinsurance. Typically, the lower a plan's monthly payments, the more you will pay in coinsurance.

You will be required to pay coinsurance and copays only until you have reached your out-of-pocket maximum. As mentioned above, the amount of the maximum is the most you will pay for covered medical expenses. It includes the total of deductibles, coinsurance, and copays. After you reach the maximum, your covered prescription and medical costs will be paid by your insurance for the remainder of the year.

Some service may require that you pay coinsurance and copay. Copay is typically a fixed fee you pay when you receive medical service, although, the amount is not always the same. It can change depending on the type of care you receive. For example, a visit to the doctor's office may come with a copay of $25, but an emergency room visit may be $200.

If you have prescriptions that need to get filled often or you go to the doctor regularly, you might want to pick a health insurance plan that has low copays for drugs and office visits. If your plan covers an annual checkup in full and other preventative care services, you most likely will not have a copay at all for these visits. Certainly, you will be free of payment obligations if you have reached your out-of-pocket maximum for the year.

High Deductible Health Plans (HDHPs) have a different set of rules when it comes to copays compared to other types of plans. Usually, people with HDHPs must pay their deductible before the insurance will pay for any other services outside of preventative care.

What Is the Difference Between Aggregate and Embedded Deductibles?

When it comes to members of a family plan, it is important to know if you have an embedded or aggregate deductible. An aggregate deductible refers to the amount that must be met for any or all people under the plan before your insurance begins to pay for any medical coverage.

An embedded deductible means the family deductible, but there is also one for each family member. For example, a family plan has a family or overall deductible of $10,000, and the embedded deductible for the individual family member is $5,000. Then, say one person has expenses of at least $5,000; the insurance would cover any further care for the person. If another person gets sick and needs care but the cost is only $1,000, the family will have to pay that amount. There will still be $4,000 necessary for that person's overall deductible. Insurance starts covering medical costs sooner for the individual with an embedded deductible who has large bills than it would for the family to reach the overall deductible.

If you need help dealing with copay after deductible, you can post your legal need on UpCounsel's marketplace. UpCounsel accepts only the top 5 percent of lawyers to its site. Lawyers on UpCounsel come from law schools such as Harvard Law and Yale Law and average 14 years of legal experience, including work with or on behalf of companies like Google, Menlo Ventures, and Airbnb.